Welcome to this week’s edition of 4 Customs Street, our weekly newsletter on the stock market.

The newsletter is divided into two parts:

Green White Green is focused on the Nigerian stock market.

Star-Spangled Banner is focused on the US stock market

Green White Green Last Week

Jude Chiemeka has been appointed CEO of the Nigerian Exchange Limited (Nigerian Stock Exchange) effective July 1, 2024. He has served in acting capacity since January 1, 2024. He succeeds Temi Popoola who moved to the role of Managing Director/CEO of the group.

Making room for more

Fidelity Bank may be anticipating robust demand in its ongoing rights issue and public offer.

The firm will be holding an extraordinary general meeting on July 26 where it will be seeking shareholder approval to accept surplus monies arising from surplus subscription of the combined offer subject to regulatory approval.

A bit longer

Oando shareholders may have to wait a bit longer for its 2024 Q1 and Q2 numbers.

The company informed the stock exchange that it will file them alongside its audited FY 23 numbers by Monday September 30, 2024.

Why so late? The company had some key shareholder disagreements a few years ago that led to a few court cases and other actions that prevented the firm from filing them.

Green White Green This Week

This week is an extremely busy one.

Access Holdings (parent company of Access Bank) will open its rights issue today.

The rights issue is for 17.7 billion ordinary shares at N19.75 each on the basis of 1 share for every 2 shares held as at June 7, 2024.

The offer will close on Wednesday August 14, 2024.

A rights issue is when a company sells shares to its existing shareholders.

GTCO (parent company of GT Bank) will hold a "Facts Behind the Offer" presentation at the stock exchange this afternoon.

Fidelity Bank's combined offer is also ongoing.

Star-Spangled Banner Last Week

Tesla deliveries came in slightly higher than estimates. The company delivered 443,956 vehicles as against the 439,000 estimates analysts had expected.

For the automaker, delivery numbers are closely watched because they are the closest approximation to sales.

Boeing pleaded guilty to criminal fraud by violating a settlement agreement made in 2021 following the 737 Airmax plane crashes.

The firm will pay a $243.6 million fine. An independent compliance monitor would also be installed to oversee compliance at Boeing for three years during a probationary period. It would also have to invest at least $455 million in compliance and safety programmes.

Breezing into crypto

Cryptocurrency prices dipped last week following the defunct exchange, Mt. Gox, releasing some money to its creditors.

The German government sold bitcoin that it had seized.

Star-Spangled Banner This Week

Earnings season kicks off properly this week as Citigroup, JP Morgan Chase, and Wells Fargo will release their second-quarter numbers.

Bank results are closely watched as their data gives considerable insight into consumer spending.

Delta Airlines and PepsiCo will also drop their earnings.

On the macro front, inflation numbers for the month of June will also be released within the week. Most analysts expect a marginal increase month-on-month.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

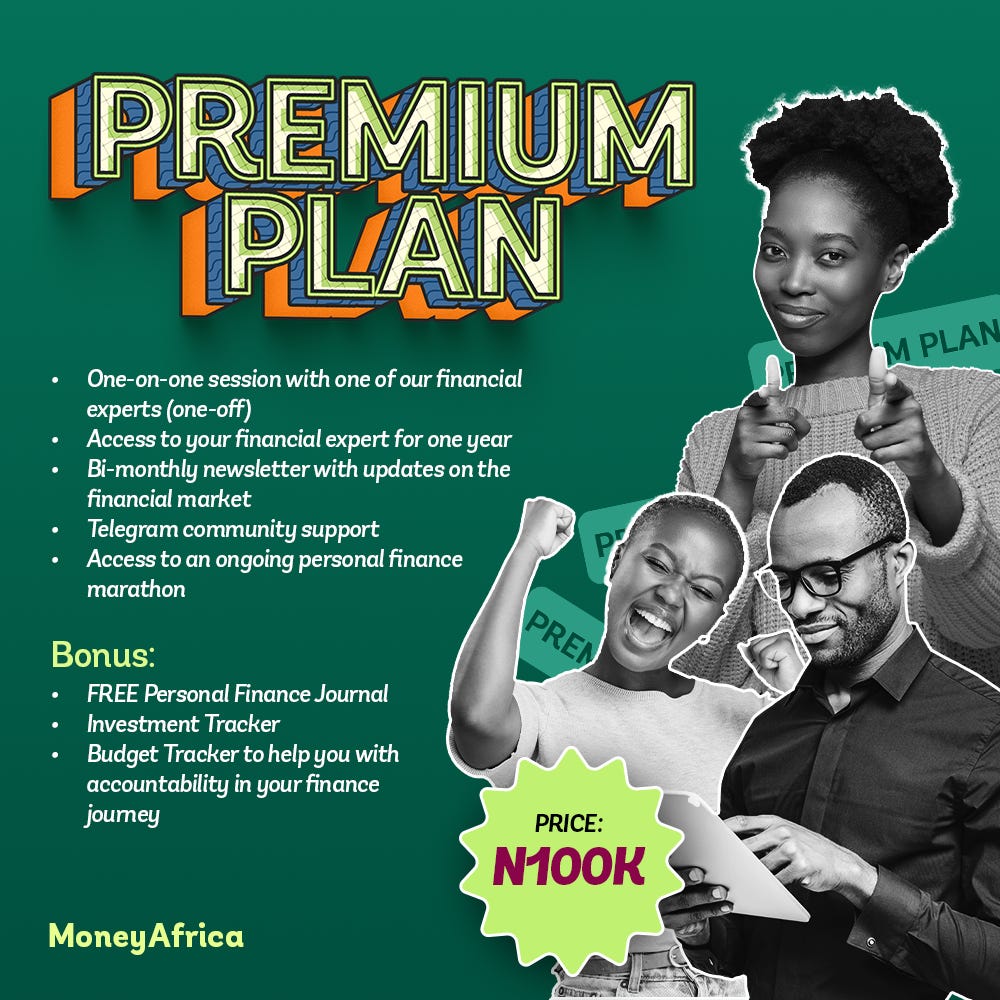

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

Get a budget sheet to track your monthly expenses. Click here

Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

- social media handles

- platforms for paid community members (for adults and students)

- webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company's staff? Please send an email to info@themoneyafrica.com