Welcome to this week’s edition of 4 Customs Street, our weekly newsletter on the stock market.

The newsletter is divided into two parts:

Green White Green is focused on the Nigerian stock market.

Star-Spangled Banner is focused on the US stock market

Green White Green This Week

The Securities and Exchange Commission (SEC) has declined approval for PZ Cussons Offer to buy minority shares at an offer price of ₦23 per share.

Adaora Umeoji has been appointed GMD/CEO of Zenith Bank effective June 1, 2024. She will take over from Ebenezer Onyeagwu whose tenure expires on May 31, 2024

IFRS 17 adoption causing delays

AXA Mansard Insurance Plc, Guinea Insurance, and Veritas Kapital Assurance disclosed they may be unable to file their audited FY 2023, and Q1 2024 numbers due to the introduction of the IFRS 17 Accounting Standards which require several changes in the disclosure methods.

The National Insurance Commission (NAICOM) has obtained, on behalf of insurance companies, a general approval for an extension of the time for submission of the accounts.

Green White Green This Week

Nestle Nigeria’s board will meet today, Monday, March 25, to consider the company’s negative assets.

Geregu Power will hold its Annual General Meeting on Thursday, March 28, 2024 at 10:00 a.m.

A few other firms will be holding board meetings to consider their audited FY 2023 numbers. They include Cadbury Nigeria, UAC, and Caverton Offshore Support Group (COSG).

The Central Bank of Nigeria (CBN) will also be holding its second Monetary Policy Committee (MPC) meeting for the year this Monday and Tuesday. The broad expectation is that interest rates will go up. That means higher lending costs.

Bank earnings typically are out sometime around now, and there will be a focus on any policy changes or announcements that could affect them.

Star-Spangled Banner Last Week

Apple catches a case

The US Department of Justice (DOJ) filed a lawsuit against Apple accusing the company of being a monopoly via its ecosystem. (Simply put: Apple is a dominant smartphone seller and essentially locking its users within its family of products).

The news led to a 4% dip in the stock price last Thursday,

Nike

Nike released its Q3 2024 results last week, and there was good news and not-so-good news. The good news was that gross margins went up (gross margins is the figure obtained when revenue is subtracted from the cost of goods).

China sales also came in just about as forecasted at $2 billion. China is a key region for the company because of its size and in view of the simmering trade war between the United States and China.

The not-so-good news was that the company expected revenue to grow by 1% in the 2025 financial year, which was rather poor.

Reddit we go

Shares of social media platform Reddit began trading last Thursday following its Initial Public Offer (IPO). An IPO is when a company sells shares to the public for the very first time. The stock ended the week, down by 14.46%.

Star-Spangled Banner This Week

This week is a rather quiet one in terms of major company earnings. Walgreens Boots Alliance and Carnival are the key names expected to drop their quarterly numbers

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

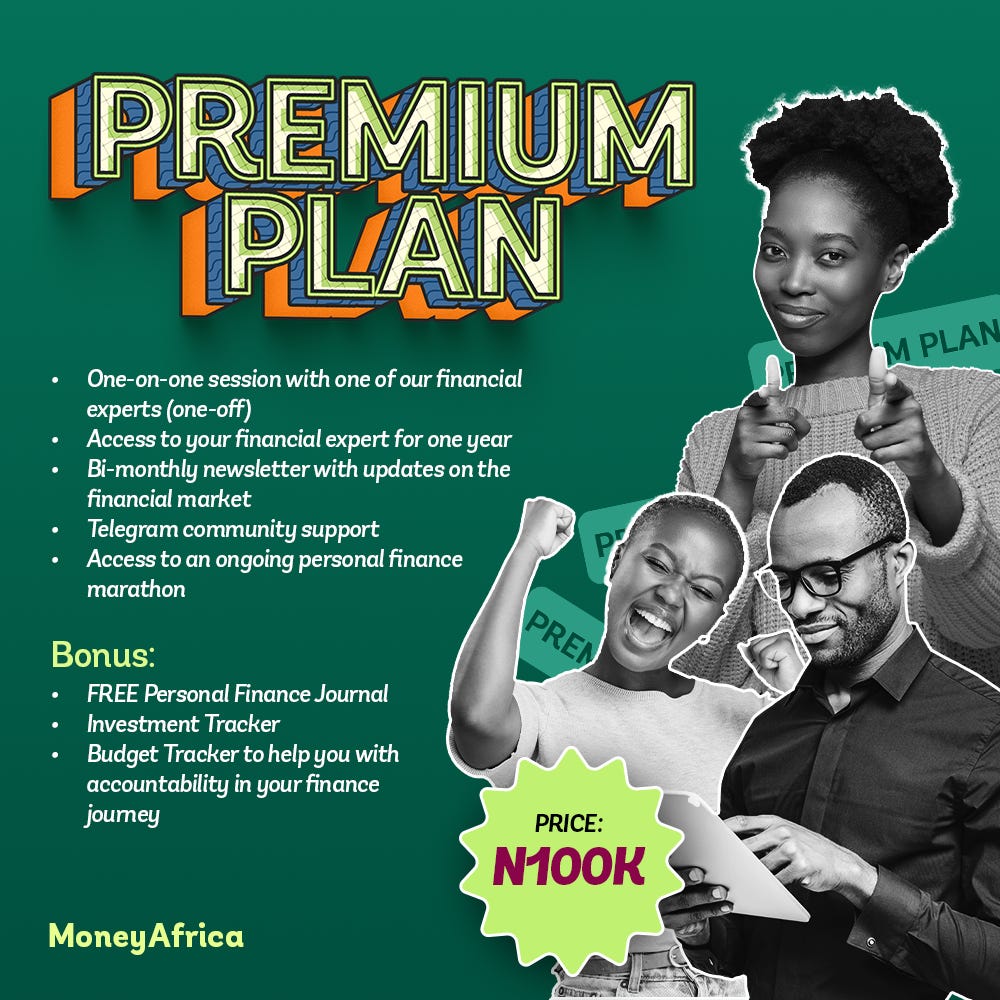

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

Get a budget sheet to track your monthly expenses. Click here

Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

- social media handles

- platforms for paid community members (for adults and students)

- webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company's staff? Please send an email to info@themoneyafrica.com