Welcome to this week’s edition of 4 Customs Street, our weekly newsletter on the stock market.

The newsletter is divided into two parts:

Green White Green is focused on the Nigerian stock market.

Star-Spangled Banner is focused on the US stock market

Green White Green Last Week

The NGX ended last week’s trading on a positive note as the All-Share Index gained 1.73%. It also closed the month of May in the green.

FMN records a loss

Flour Mills of Nigeria recorded a loss before tax of N236 million in FY 2024 due to a spike in finance cost following last year’s devaluation. For the full year, it recorded a profit after tax of N3.5 billion due to an income tax credit.

The firm has proposed a dividend of N1.80 per share amounting to N7.38 billion.

FBN FY 2023 and Q1 2024 earnings call

Last week, FBN Holdings (parent company of First Bank) held an earnings call. Management discussed a bunch of things including plans to raise more capital, goals for First Bank and outlook for the year.

On capital raising

Prior to the CBN circular on new capital requirements for banks, the bank had planned to raise N150 billion. Now it is looking at N300 billion or more to be raised through a combination of rights issue (selling shares to existing investors), private placement (selling shares to a select investor) and public offer (selling shares to the public). The capital raise will be concluded by December 2024.

Why such a small dividend (40 kobo for FY 2023)?

Dividend payment was muted to boost the capital adequacy ratio (CAR) of the bank.

Focus of the new First Bank MD

Segun Alebiosu, the Acting Managing Director, shared his focus for First Bank.

“We have our strategic plan and there will be no deviation from that. If you look at management, we are all intact. Exactly what we have done in the past is what we will continue to do. Essentially growth. Strong financial performance, stability and governance.”

Bouncy insurance numbers

FY 2023 and Q1 2024 numbers for insurance companies have started to trickle in. The late arrival was due to transition to the latest financial reporting standards.

A common thread running through all the numbers was a huge bounce in profit due to foreign exchange gains.

AXA Mansard had a sharp bounce in FY 2023 and Q1 2024 numbers due to FX gains. So it is best to look a bit deeper.

Insurance revenue was up from N69.2 billion in 2022 to N82.7 billion in 2023. Life insurance grew the fastest.

Insurance service results (essentially core insurance income after deducting expenses) went up circa 40% from N8 billion in 2022 to N11.2 billion in 2023 and was driven by higher revenue.

Investment return went up by 265% from N4.7 billion in 2022 to N17.2 billion in 2023 due to FX gains.

Profit for the year was up nearly 5X from N2.5 billion in 2022 to N12 billion in 2023.

The firm has proposed a final dividend of 34 kobo. Last year, it paid an interim dividend of 6 kobo, bringing FY 2023 dividend to 40 kobo.

NEM Insurance had significant FX gains in both FY 2023 and Q1 2024.

For FY 2023, there was a slight decline in the insurance service numbers. It dipped year-on-year from N6.2 billion in 2022 to N5 billion in 2023.

Net investment income went up by more than 9X from N2 billion in 2022 to N19.3 billion in 2023.

Profit after tax went up by over 100% from N5.4 billion in 2022 to N12.9 billion in 2023.

The firm has proposed a 60 kobo dividend which will be paid on Tuesday, July 2, 2024. Qualification date is Thursday, June 20, 2024.

For Q1 2024

There was a decent uptick in insurance income. It went from N3.1 billion in 2023 to N12.9 billion in 2024.

Net investment result went up from N318 million in 2023 to N585 million in 2024.

Profit after tax went up more than 5X from N1.8 billion in 2023 to N10.5 billion in 2024.

Green White Green This Week

We expect more insurance companies to release their earnings. Unfortunately, they have a poor record of holding earnings calls, so we can’t get much insight into their outlook for the year.

We should also have some more details about capital raising plans by the banks.

Star-Spangled Banner Last Week

Last week was full of firsts. The NASDAQ index crossed the 17,000 mark for the first time ever. This was fuelled by the rise in the share price of chip maker Nvidia.

May was a positive month for the 3 major stock market indexes.

The Dow gained 2.3% last month.

The S&P 500 rose 4.8%. The Nasdaq gained 6.88%.

Star-Spangled Banner This Week

Memestock GameStop is back in play this week, as influential trader Keith Gill popularly known as Roaring Kitty shared a screenshot of the stock in his portfolio. Gill resurfaced a few weeks ago, sending the stock price into a frenzy.

A memestock is one that gains popularity among retail investors on social media. A few years ago, GameStop was the object of a tussle between retail traders who bid this stock up and larger trading firms who bet in the opposite direction and lost money.

You can learn more about this from the Netflix documentary.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

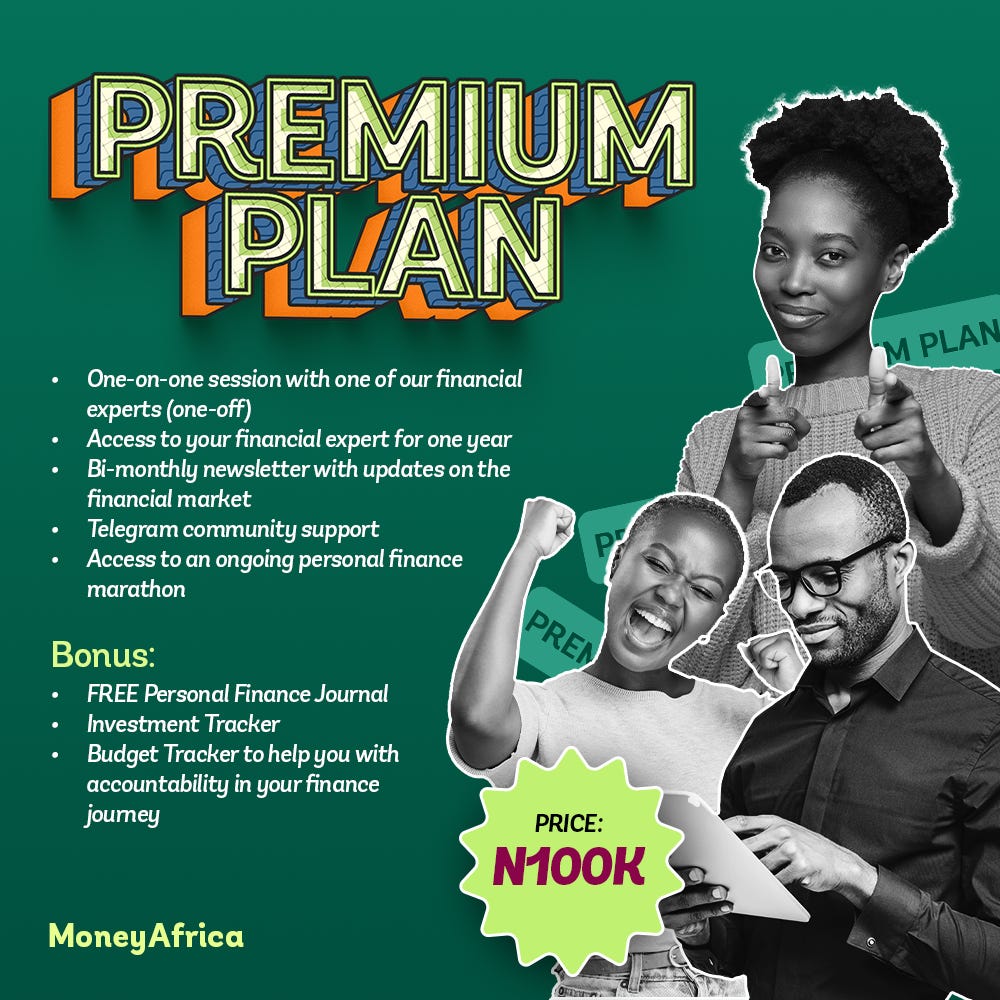

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

Get a budget sheet to track your monthly expenses. Click here

Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

- social media handles

- platforms for paid community members (for adults and students)

- webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company's staff? Please send an email to info@themoneyafrica.com