Investing in Dollar-denominated Assets

Good Morning 😃

How are you doing?

It is no longer news that Nigerians are increasingly moving their investment to dollar-denominated assets in order to diversify their portfolios and minimise their exposure to naira devaluation. The naira has been depreciating against the dollar across the Nigerian foreign exchange market in recent weeks.

Depreciation is a decrease in the value of domestic currency due to market forces of demand and supply under flexible exchange rate system. In Nigeria, the exchange rate depreciates by around 6–7% annually over the long term. The Naira has depreciated by 51% from N360/$1 in 2019 to N742/$1 as of Friday October 15, 2022, in the parallel market, popularly called the black market.

Therefore, the need to hedge against the sustained devaluation of naira has resulted in rising investors’ appetite in dollar-denominated assets.

What are dollar-denominated assets?

Dollar-denominated investments are assets, securities and transactions priced in US dollars. Investors invest in these classes of assets and earn returns in dollars.

Types of dollar-denominated assets

Domiciliary account: This allows you to save in dollars in Nigeria by opening a domiciliary account in any of the commercial banks in Nigeria. A domiciliary account is a type of bank account that you can use to receive and make payments in foreign currencies like the US dollars.

Dollar mutual funds: Mutual funds are a type of investment made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money-market instruments, and other assets. Dollar mutual funds are mutual funds investments denominated in US dollars.

Eurobonds: Eurobonds are bonds that are issued in international currencies—currencies different from the host country’s currency (in the case of Nigeria, currencies that are not naira).This way, the government borrows in dollars and pays back interests in dollars as well.

For example, the Nigerian government can issue a bond to foreign investors that allows them to lend the Nigerian government money in dollars and not naira (since they don’t spend naira in their country).

Foreign stocks and ETFs: This involves investing in stocks of publicly listed companies on the floor of the foreign stock exchanges such as S&P and Nasdaq in the US. Investors buy units of shares of a company listed, say, Tesla for $100 per share depending on trading price as at time of purchase. Unlike bonds that have a fixed rate of return, investing in shares gives you the opportunity to earn through capital appreciation and dividend repayment (for some stocks).

Fintech dollar options: Using a fintech app is another way to save in dollars. Some fintechs offer dollar saving products that enable you to save your money in dollars and earn interest as well.

Cryptocurrency: There are some cryptocurrency platforms that allow you to buy, sell and convert cryptocurrencies like Bitcoin, Ethereum, BNB, Chainlink and TRON cryptocurrency. Some people buy the near-stable coin such as USDT (USD tether) or BUSD (Binance USD) in order to protect themselves against currency devaluation.

Benefits of having dollar-denominated assets

Interest payment on investments like eurobonds and periodic payout for dollar mutual funds.

Return as a result of exchange rate difference, i.e. the return from the changes in the value of the naira against the dollar.

Settlement of dollar obligations. This could be school fees of a child abroad, healthcare or the need to fund trips abroad.

Diversified portfolio. This allows you to hedge your investments against market and currency risk such as inflation and devaluation.

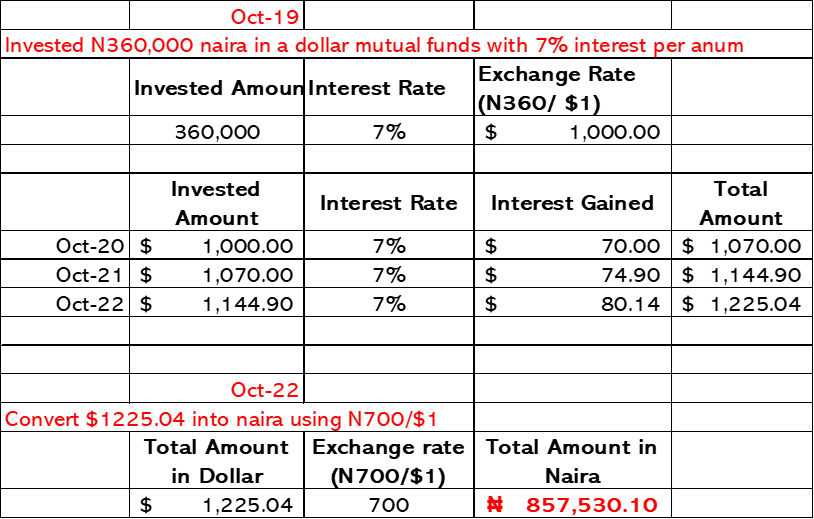

An Illustration of Exchange Rate Difference Gain

In January 2019

You invested NGN360,000 with a return of 7% per annum in a dollar mutual fund. This is converted to USD1,000 at an exchange rate of NGN360 per USD.

In 2022

Naira loses its value against the USD, the exchange rate becomes NGN700 per USD. The USD1,000 you invested would have earned 7% at the end of the first year: 7% x USD1,000 = USD70. This implies you had USD1,070 by the end of the first year. The USD1,070 would also have earned 7% by the second year: 7% x USD1,070 = USD74.9. This implies you had USD1,144.9 as the total value of your investment by the end of the second year. If by 2022, you decide to liquidate your investment, you would have USD1,144.9 + USD80.143 = USD1,225.043. When you convert this value to naira at the exchange rate of NGN700 per USD, this gives USD1,225.043 x 700 = NGN857,530.

Now compare this to your initial NGN360,000 naira that you invested. Can you spot the huge difference as a result of exchange rate volatility?

Portfolio diversification

At this point, having all your investments in dollar-denomimated funds might seem like the best option. It is also important to note that high returns is not the only reason for saving or investing your money. Other reasons include liquidity (to meet short term financial obligations), risk protection (every investment has its own risk element), setting a target or goal (paying for a professional course, buying your first car or house), etc. It is important to note that various asset classes react differently to economic happenings.

So how best should you access your investment goal?

It is best to access your overall investment goal before making the decision.

What are your financial goals?

How long are you willing to invest?

What are your short-term obligations?

Is your portfolio risk-proof?

Our financial experts are readily available to guide your investment decisions. You can reach out to us on info@moneyafrica.com to help you plan your investments.

Did you find this newsletter useful? You can read previous newsletters here

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

MoneyAfrica Premium Plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Simply follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about how you can invest safely and build a solid portfolio in 2022.

Don’t forget to:

Join our community, if you are interested in smashing your 2022 financial goals. Remember it takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

If you would like to document your financial journey in 2022, then our journal would be a great fit for you. It costs ₦7,500 (excluding delivery).

Get a budget sheet to track your monthly expenses. Click here

Get an investment tracker to be on top of all your investment. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone become better with their finances.

We do this by engagements via our:

- social media handles

- platforms for paid community members (for adults and students)

- webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for the staff of your company? Please send an email to info@themoneyafrica.com