Welcome to this week’s edition of Investment Research Market Commentary.

Global Market Update

China’s Stimulus Supports Equities

The rebound of the Chinese stock market is still the big story this week. Following stimulus (lower rates, subsidies, etc.) measures announced by China to support its 5% growth target for 2024, Chinese stocks gained an additional 8.1% before the holidays—a slight movement from +12.8% in the prior week.

Meanwhile, despite fears of an economic slowdown in the US, Job creation remained resilient at 254,000 jobs in September 2024—the highest since March 2024. Also, unemployment slowed to 4.1% in September 2024 from 4.2% in August 2024.

The S&P 500 gained 0.2% compared to +0.6% in the week before. In the UK, the FTSE 100 lost 0.5% from +1.1% in the prior week. Globally, as represented by the MSCI World Index, stocks declined 0.8% from +1.4% in the previous week.

What this means for you: The strong momentum in China has our attention, but we are not sure it will be sustained. The Chinese stock market has been the worst performing over the past decade due to strict regulation in China. We continue to position in the US market until we see fundamental changes that can support Chinese stocks over the long-term.

Nigeria’s Market Update

Macro Update

New Incentives for Oil and Gas Exploration

To revive the slump in the oil and gas sector, the Presidency announced tax credits for deepwater exploration and production. Over the past decade, Nigeria has struggled to attract new investments into the oil and gas sector while existing players are divesting. While this incentive is a good move, it is unlikely to move the needle given issues that remain unresolved. Nigeria is basically not as competitive as other oil producing countries on business environment, cost and fiscal terms.

With a target of 4 million barrels per day (mb/d) by 2030 (almost 3x current 1.4mb/d production), Nigeria would need to attract more investment than its target of $5–$10bn. Such an ambition would require radical reforms in the oil sector which would make Nigeria competitive and inspire investor confidence. Unfortunately, the Petroleum Industry Act (PIA, 2021) which took 13 years to pass failed this test. A longer wait for truly transformative reforms would prove even more costly.

What this means for you: Nigeria faces long-term issues in the oil sector that will affect exports, which provide crucial support for the economy. There are no quick fixes, and even the best attempts at diversifying exports will take time. Without monetary and fiscal discipline, the current economic slump is likely to be prolonged, and high inflation and currency depreciations would persist. For long-term investors, we continue to recommend a diversification away from Nigeria.

Equities Update

Nigerian Stocks Decline

Nigerian stocks lost 1% this week and the YTD (year-to-date) gain stands at 30.4% now. On a dollar adjusted basis, Nigerian stocks have lost 29.2% YTD.

Market performance was uneven as the oil and gas and consumer goods sectors gained 7.3% and 0.3% respectively, while industrial goods and banking stocks lost 6.8% and 0.7% respectively.

What this means for you: We do not like Nigerian stocks right now as long-term investors. Investing in the S&P 500 would have delivered a dollar return of 20.6% YTD and naira return of 122.3%, which is better. Until we see a consistent trend of macroeconomic stability, which will be obvious in low inflation and stable exchange rates, we maintain an exposure to the US market.

Fixed Income Update

Higher Yields in the Money Market

The yield on 91-day and 182-day treasury bills rose to 31.69% and 24.33% respectively from 18.6% and 22.63% in the prior week. Yield on the 364-day treasury bill slightly was moderated to 22.3% from 22.39%.

In the bond market, where the FG borrows for more than a year, yields rose to an average of 18.81% from 18.65% in the prior week.

What this means for you: The higher yields on treasury bills mean you can earn a higher return if you are saving for short-term goals (rent, school fees, etc.) in naira. You can do this with us on Ladda, a fintech app that helps you save at high returns. We do not recommend naira treasury bills and bonds for long-term investing.

FX Update

Naira Weakens by 4.3%

The exchange rate closed at 1,657.86 on the official market, depreciating by 4.3% from 1,586.26 last week. This is despite a 1.4% increase in external reserves to $38.58bn, the highest level since September 2022.

What this means for you: While the depreciation in the naira could lead to further increases in consumer prices, the increase in external reserves is slightly reassuring as the CBN should be able to support the naira at current levels. Remember to always save for your dollar goals in dollars. You can do this with us on Ladda, a fintech app that helps you save at high returns.

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

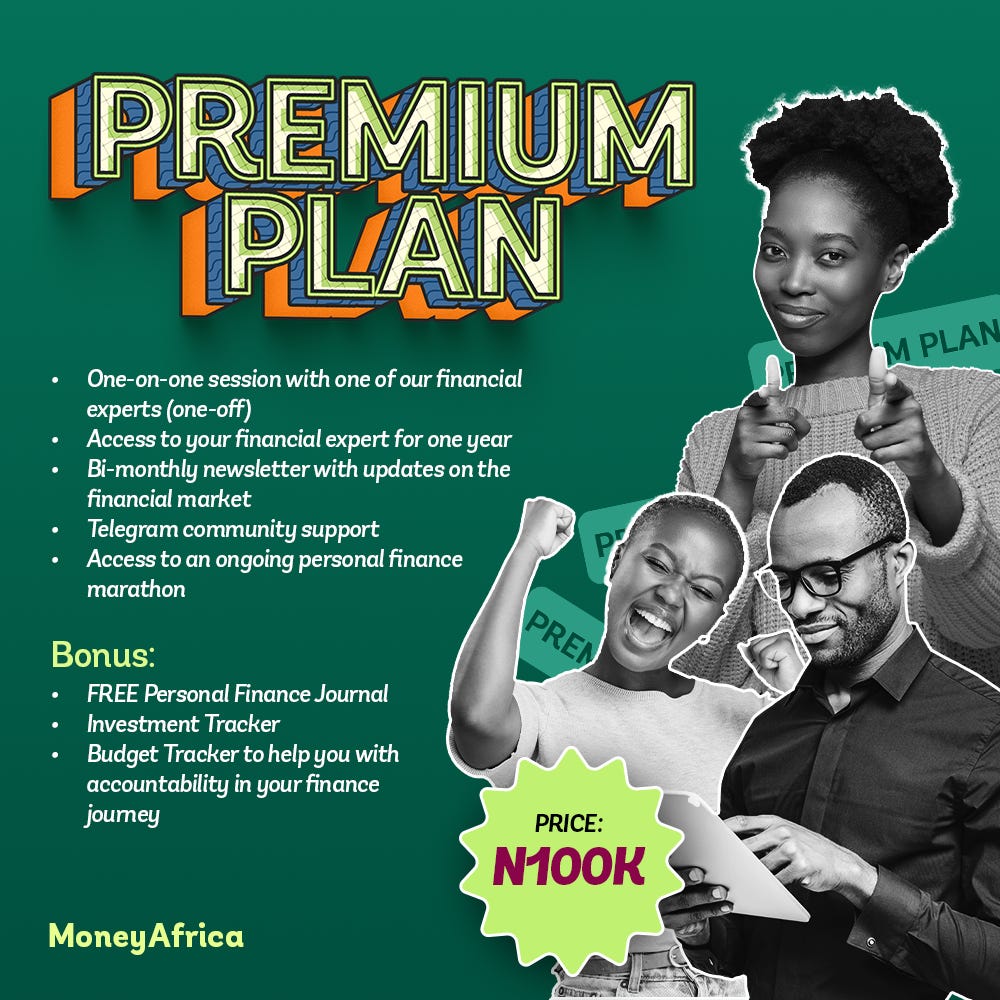

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

Get a budget sheet to track your monthly expenses. Click here

Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

- social media handles

- platforms for paid community members (for adults and students)

- webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company's staff? Please send an email to info@themoneyafrica.com