Good Morning

Happy New Year!!!

Welcome to this week’s edition of 4 Customs Street, our weekly newsletter on the stock market.

The newsletter is divided into two parts:

Green White Green is focused on the Nigerian stock market.

Star-Spangled Banner is focused on the US stock market.

Green White Green Last Week

Last week was the final trading week for 2023. Rounding up what was a broadly successful year for the NGX. The All-Share Index gained 45.9%. The index measures the average performance of stocks on the exchange.

Transcorp Hotels was the best-performing stock in 2023. The stock opened at N6.25 and closed at N70.18, up 1,022.88%.

The worst-performing stock was Royal Exchange. It declined by 40.57%, opening at N1.06 and closing at 63 kobo.

Vitafoam FY 2023 numbers

Vitafoam released its results for the financial year ended September 2023. There was a slight decline in revenue and profit.

Revenue for the group dipped by 14% from N52.9 billion in 2022 to N46.3 billion in 2023.

Profit after tax declined by 3% from N4.5 billion in 2022 to N4.3 billion in 2023.

The key drivers behind the decline in revenue were higher administrative expenses and cost of sales.

The firm has proposed a N1.56 dividend, which will be paid to shareholders (who hold the shares on or before February 12, 2024) on March 7, 2024.

Management changes at the NGX and NGX Group

Temi Popoola has been appointed GMD/CEO designate of the Nigerian Exchange Group (parent company of the stock exchange) effective January 1, 2024 subject to the Security and Exchange Commission’s formal approval of the appointment.

The current GMD/CEO, Oscar N. Onyema will complete his tenure on March 31, 2024. Ahead of this, he will embark on his terminal leave effective January 1, 2024.

Jude Chiemeka has also been appointed as the Acting Chief Executive Officer (CEO) of Nigerian Exchange Limited (NGX), effective January 1, 2024.

Temitope Fasoranti, an Executive Director of Zenith Bank, retired effective December 29, 2023. EDs are part of the senior management team of a company.

Green White Green This Week

Today is January 1, 2024. The stock exchange will be closed. We expect more companies to give notice of when their boards will meet to consider their audited full-year financial statements. We also expect them to provide forecasts for the first quarter of the year.

Star-Spangled Banner Last Week

It was a great year broadly for stocks in the United States as well.

The NASDAQ 100 (which is made up of mostly tech stocks) appreciated by 55%. The S&P 500 rose by 26%. The Dow Jones Industrial Average (commonly known as the Dow) gained 13.5%.

Alphabet (parent company of Google) has settled a $5 billion lawsuit that claimed it invaded users' privacy by tracking them even when they were browsing in private mode.

Star-Spangled Banner This Week

This week is a somewhat sleepy one being the first trading week of the year. Constellation Brands, Walgreen Boots Alliance, and Calmaine Foods will release their earnings for the quarter.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

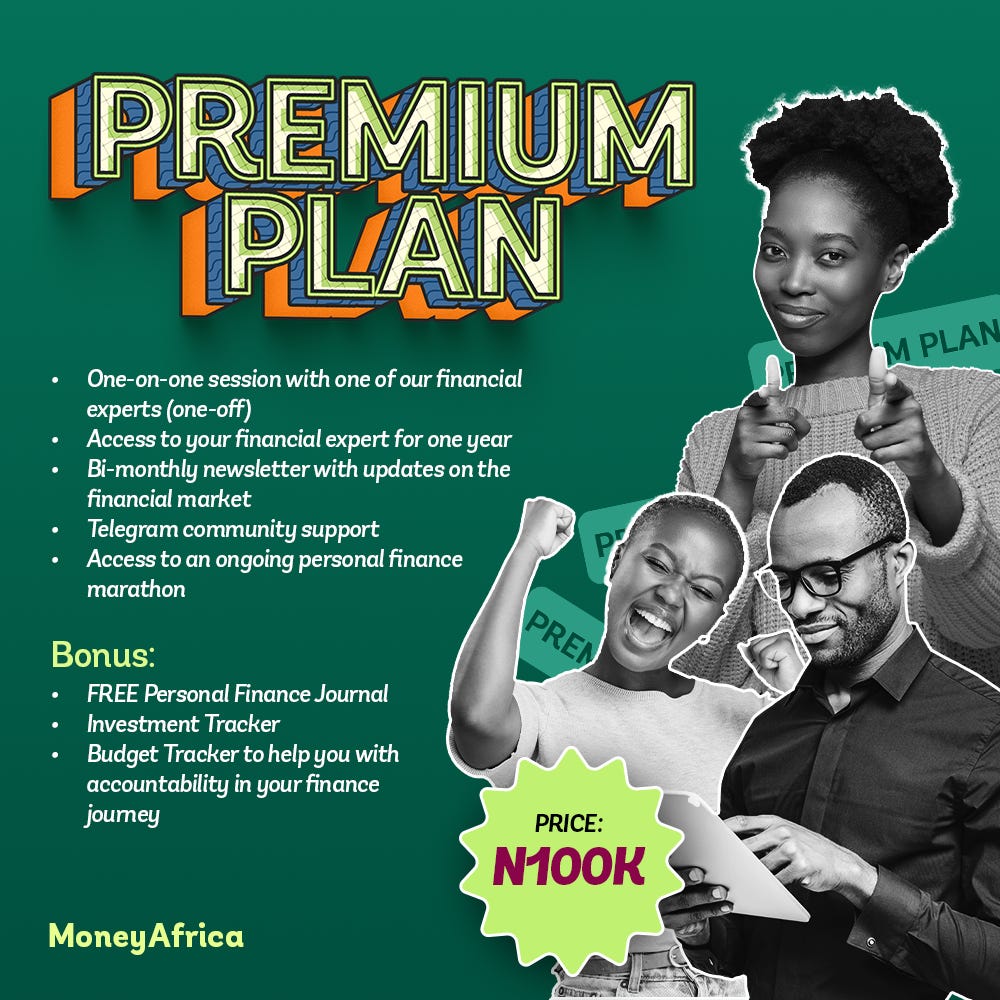

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

Get a budget sheet to track your monthly expenses. Click here

Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

- social media handles

- platforms for paid community members (for adults and students)

- webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company's staff? Please send an email to info@themoneyafrica.com