Welcome to this week’s edition of 4 Customs Street, our weekly newsletter on the stock market.

The newsletter is divided into two parts:

Green White Green is focused on the Nigerian stock market.

Star-Spangled Banner is focused on the US stock market

***

Green White Green Last Week

GTCO (parent company of GT Bank) released its results for the 6 months ended June 2024.

Gross earnings rose by 107% from N672 billion in 2023 to N1.3 trillion in 2024.

Profit for the year went up by 223% from N280 billion in 2023 to N905 billion in 2024.

The factors behind the jump were higher net interest income and unrealised gains.

Net income went up by more than 3X from N94 billion in 2023 to N444.1 billion in 2024. Net interest income is the difference between interest income (money earned on loans and investments like treasury bills) and interest expenses (such as interest paid on deposits).

Unrealised gain on forward transactions went up from N16 billion in 2023 to N130 billion in 2024.

Unrealised fair value gain on financial instruments went up from N253 billion in 2023 to N493 billion in 2024.

The company doubled its interim dividend from 50 kobo paid last year to 100 kobo (N1).An interim dividend is one paid before the end of a company’s financial year.

It also held an earnings call last week where Group CEO Segun Agbaje answered questions on a wide range of things such as the firm’s performance, Habari, its payment subsidiary, East African operations, to name a few.

Why hasn't the FY 2024 guidance changed?

We have never changed our guidance (in the middle of the year). Where we were behind, we didn't try to bring it down. We might have internal guidances that are different but publicly we never change our guidance. We have never done it.

The way we look at this is that it's only half time. These are half year results. We are going to have to remain focused and put our foot down and end the year strong. While we agree we are ahead, these are half time results and we would rather not change it.

On full-year dividend

We would have liked to pay more last year but we ran into all the revaluation gain problems and then we had a 25% restriction because we had about 15%, 16% forbearance loans.

CBN rules state if you are above 15%, you have to withhold 25% of what you can pay as dividends.

We will not have any (forbearance loans) at the end of this year. Rather, we will provide it 100%. I think you can count on a healthy end of year dividend.

The Central Bank of Nigeria (CBN) had in essence allowed banks to restructure loans that were especially knotty. These are the loans known as forbearance loans. Part of the terms and conditions for this was depending on the quantum of forbearance loans you have, there are restrictions on how much you can pay out as dividends.

Zenith Bank has obtained the approval of the Securities and Exchange Commission (SEC) to extend the period of the Rights Issue by two (2) weeks. Consequently, trading in the bank’s rights will now close on Monday, September 23, 2024.

A rights issue is when a company sells new shares to existing shareholders.

Trading in the rights issue opened on Thursday, August 1, 2024.

The bank is offering 5,232,748,964 ordinary shares at N36 per share, on the basis of one (1) new ordinary share for every existing six (6) ordinary shares held as at the close of business on July 24, 2024.

Green White Green This Week

Nigerian Breweries has a facts-behind-the-offer event at the stock exchange this Tuesday. The company is currently in the marketing seeking to raise N600 billion through a rights issue of 22,607,491,232 ordinary shares at 50 kobo each, priced at N26.50 per share on the basis of eleven (11) new ordinary shares for every existing five (5) ordinary shares held.

Star-Spangled Banner Last Week

Last week was the best performing week so far in 2024 for stocks, after the tumble two weeks ago.

The S&P 500 gained 4%.

The NASDAQ Composite rose 6%.

The Dow Jones gained 2.6%.

Apple’s $10 billion bill

A court in Europe ruled Apple must pay around 13 billion euros in back taxes to Ireland.

The commission in 2016 ordered Dublin to recover up to 13 billion euros ($14.4 billion) in back taxes from Apple at the time saying that the tech company had received “illegal” tax benefits from Ireland over the course of two decades.

Nothing like having a chunk of money. It appears the firm had held the cash in escrow and will transfer it to Ireland.

Still on Apple

Last week the company launched the iphone 16 line up, as well as its latest smart watch and ear pods.

The iPhone 16 starts at $799, and 16 plus starts at $899.

The iPhone 16 Pro starts at $999, and the Pro Max starts at $1,199.

One day one trouble at Boeing

Boeing has had so many bad news headlines this year that it has become normal. Defective parts. Delays in production, settlements with the Securities and Exchange Commission (SEC).

So what is the latest?

CEO Kelly Ortbeg, who resumed last month is having his first baptism of fire.

Workers at the firm commenced a strike, following a breakdown of talks between management and the workers union. This is the first strike since 2008.

The proposed contract had offered a 25% pay increase over four years, a $3,000 signing bonus, and reduced healthcare costs. Boeing also promised that the next commercial jet would be produced in a unionized Seattle facility. Despite these provisions, 95% of union members voted against the deal, demanding a 40% pay raise over three years, an annual bonus, and the reinstatement of traditional pensions.

Star-Spangled Banner This Week

The star event for the week is the US Fed (central bank) meeting scheduled to hold this week. At this point, it is almost a done deal that the interest rates will be cut. That is broadly positive for the stock market. Lower interest rates mean firms' finance costs should come down a bit. Lower interest rates (at least in theory) mean you have more money chasing higher risk.

What is unknown is the magnitude of the cut? Will it be 0.1%? Or 0.25% or 0.5%.

The numbers may look small but compared to the interest rates, they are quite substantial.

In terms of earnings, the only major numbers are General Mills and Fedex.

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

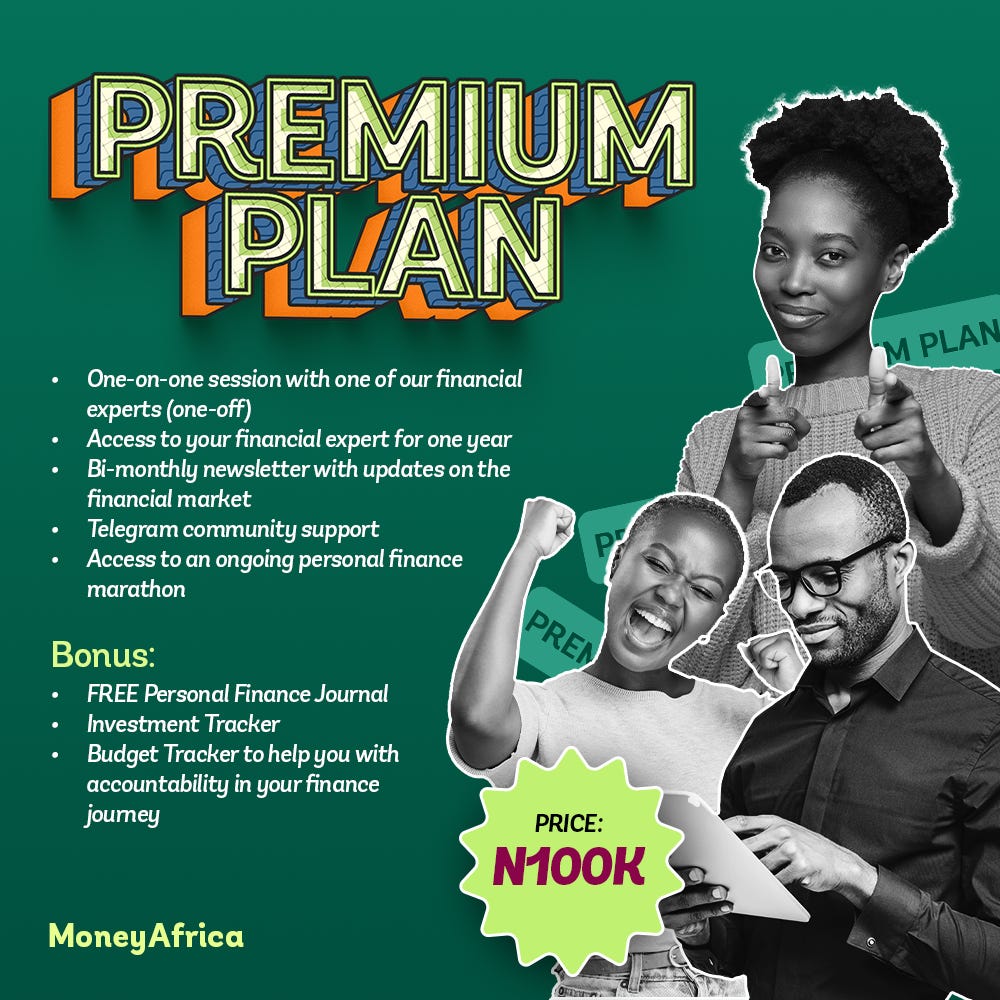

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

Get a budget sheet to track your monthly expenses. Click here

Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

- social media handles

- platforms for paid community members (for adults and students)

- webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company's staff? Please send an email to info@themoneyafrica.com