Welcome to this week’s edition of 4 Customs Street, our weekly newsletter on the stock market.

The newsletter is divided into two parts:

Green White Green is focused on the Nigerian stock market.

Star-Spangled Banner is focused on the US stock market

This week’s newsletter is titled “Red, Green and Inbetween” because of the range of earnings we have seen on both stock markets. Due to the devaluation, some firms have done poorly (Airtel and Guinness Nigeria). Some have done marginally better (Dangote Cement is in this bucket). A few others have done quite well (Okomu falls in this space).

Green White Green Last Week

The NGX All-Share Index fell sharply by 2.33% last week. The index measures the average performance of stocks on the exchange. The sharp decline was due to Dangote Cement dropping by 9.99% as well as some of the baking stocks.

The decline in Dangote Cement’s share price was due to disappointing H1 2024 numbers.

Profit after tax rose by 6.3% to N189 billion in H1 (January to June 2024) despite a sharper rise in revenue. Revenue was up 85.1% to N1.8 trillion in H1 2024.

There was a sharp spike in net finance costs due to higher foreign exchange losses.

Earnings

It was a packed week in terms of earnings. By earnings, we mean the financial statements that companies release every quarter.

Airtel Africa, Dangote Cement, Okomu, The T3 firms (parent company Transcorp, and subsidiaries Transcorp Power and Transcorp Hotel), among others, dropped their earnings.

Airtel Africa and Dangote Cement held earnings calls last week.

Airtel Africa Q1 2024 earnings call highlights

This earnings call is the first by the newly appointed CEO. Management touched on a number of issues including operations in Nigeria, francophone Africa as well as areas of growth.

There was a lower contribution from Nigeria in terms of earnings. Nigeria used to contribute 40% to business but now it has come down to about 20 something percent. This is largely due to the devaluation of the naira. In dollar terms, Nigerian revenues have become smaller.

Airtel Africa remains a cost leader and the most profitable mobile network operator in Africa. The focus is on driving costs down network costs and energy costs. This will be done by deploying renewable energy solutions, intelligent network design, and renegotiating tower contracts.

Areas of growth

Fibre (home broadband and enterprise) and data centers are large future opportunities that we will focus on.

Devaluation impact on EBITDA (earnings before interest, depreciation and amortisation)

EBITDA was impacted by currency fluctuations. The naira continued to weaken in the quarter. Across the group, currency devaluation led to derivative and foreign exchange losses of $136 million. $122 million is related to the naira devaluation which has been classified as an exceptional item.

Francophone operations

The underlying metrics point at the business being healthy. Base growth is at 10%. Data consumption continues to grow at about 23%in francophone markets.

There was some slowdown in growth rate due to the three factors:

First is inflation. Francophone markets are experiencing very high inflation. Revenues have come down because average revenue per user (ARPU) has come down. ARPU slowdown is because of the impact of inflation.

The second factor is competitive activity which brought ARPU down.

The third factor was regulatory charges in Gabon and mast charges in DRC.

Nigerian operations

Nigeria is a big growth opportunity. There was 33% growth across voice and data. Nigeria remains a very large opportunity and optimistic on the growth potential. Investment in the expansion of the Nigerian network coverage and catering for customers will continue.

Nigeria is still a very large penetration opportunity in Nigeria. There has been close to a 35% increase in data consumption in Nigeria. Also, the consumption forecast mode in Nigeria is about 29% in this quarter. So far, revenue per site continues to grow.

Fiber and home broadband are large growth opportunities in Nigeria. Initial results are positive. B2B remains a large opportunity. By FY 26 the data centre being built in Nigeria should be ready.

There has not been any reduction in competitive intensity in Nigeria, be it from MTN or any operator. There is a deep concern for and the need to remain focused on the opportunities Nigeria has to offer across GSM and mobile money business.

In both categories, there is penetration opportunity and upgrade opportunity.

Mobile money operations in Nigeria

Mobile money market is a relatively more mature market when it comes to mobile money, so we are focused on acquiring customers. We have 50 million customers, a large number are smartphone users. We need to build a strong ecosystem to make our platform and our services very attractive to customers. We give them great experience and that is what we are focused on.

At what point in time do we start monetising? This is very difficult to put a number on. It's a large opportunity. We have an existing relationship with 50 million customers in Nigeria. Of these customers, a large number of customers are 4g customers. If we engage them and give them the right experience, they will give us an opportunity to serve them, not only for cash out and cash in, but also across the ecosystem. That is where our focus is—to build those capabilities and make sure our customers are engaged. Then we start to put some numbers on an excel sheet.

Jadip the CFO gave some further insight into the numbers.

Cash out still contributes a large part of the revenue bucket. 48% of the revenue comes out of the cash out commission. The yield for that is roughly 2%. Net of cash in commission comes down to approximately 1.2% /1.3%. For cash in, the customer is not charged. For cash out, the customer is charged and commission is paid to the agent. Cash in cash out commission net off is about 1.2% to 1.3%.

Cash out has started coming down. It used to be about 60% of revenue. Billpoint and merchants have started going up. There will be better yield in the merchants and billpoint ecosystem. This will be discussed in detail when we come for the half half year results call.

Dangote Cement H1 2024 call highlights

The long term vision is to achieve cement and clinker self sufficiency across Africa.

There were sharp depreciations in the Naira and Kwacha during the quarter.

Paid over 2 trillion naira as dividends in the last 14 years.

Procuring 1500 CNG (Compressed Natural Gas) trucks that can travel long distances. The plan is to phase out diesel powered trucks and replace them with 100% cmg trucks.

The Ivory Coast plant is almost completed.

Normally Q3 is supposed to be a quarter for the rains, but there has been some respite. Q3 performance will depend on the rains and is expected to do better than what was done in H1.

Earnings

Okomu Oil Palm H1 2024 revenue was up a bit over 85% from N40.5 billion in 2023 to N75 billion in 2024.

Profit on continuing operations after tax went up by 24.6% from N16.1 billion in 2023 to N20.1 billion in 2024. It grew at a much slower pace due to a spike in finance costs (up more than 6X from N1.2 billion in 2023 to N7.4 billion in 2024).

It has proposed an interim dividend of N8. That's a payout ratio of 37.7%.

Africa Prudential H1 2024 profit after tax was up 87.7% from N415 million in 2023 to N779 million in 2024.

The firm has proposed a 15 kobo dividend and a one for one bonus.

Guinness Nigeria recorded a N54.7 billion loss for the financial year ended June 2024, nearly 3X the loss it recorded in June 2023. The mega loss was due to the devaluation of the currency within the period.

Green White Green This Week

This week will also be an extremely busy one. We should get earnings from MTN Nigeria, BUA Foods and a few other firms.

United Capital and FCMB Group will hold earnings calls. FCMB Group will also hold a facts-behind-the-offer event at the stock exchange.

Star-Spangled Banner Last Week

Last week, the S&P declined -0.8%, the Nasdaq Composite slipped -2.1% as the rotation from tech stocks continued, leaving the Dow a beneficiary. The Dow gained 0.8%.

A detour into cryptocurrencies. Ethereum Exchange traded funds began trading following approval by the Securities and Exchange Commission (SEC).

Alphabet and Tesla shares dipped as markets were disappointed with some of their operations. Alphabet had slightly softer revenue from YouTube (which management gave a cogent explanation but markets are irrational). Tesla’s share price also dipped following weak automotive revenue.

Star-Spangled Banner This Week

This week is the busiest week of the earnings season. Tech giants, Apple, Microsoft, Meta (Facebook) and Amazon will be releasing their most recent quarterly numbers.

Other key firms that will drop earnings include, Pfizer, Starbucks, Boeing, Pfizer, Amazon, Apple, Intel, Chevron and Exxon Mobil.

The US Fed (central bank) will be meeting. Expectations are that interest rates would be left unchanged. What the financial markets would be watching for are an inkling they would be cut in September.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

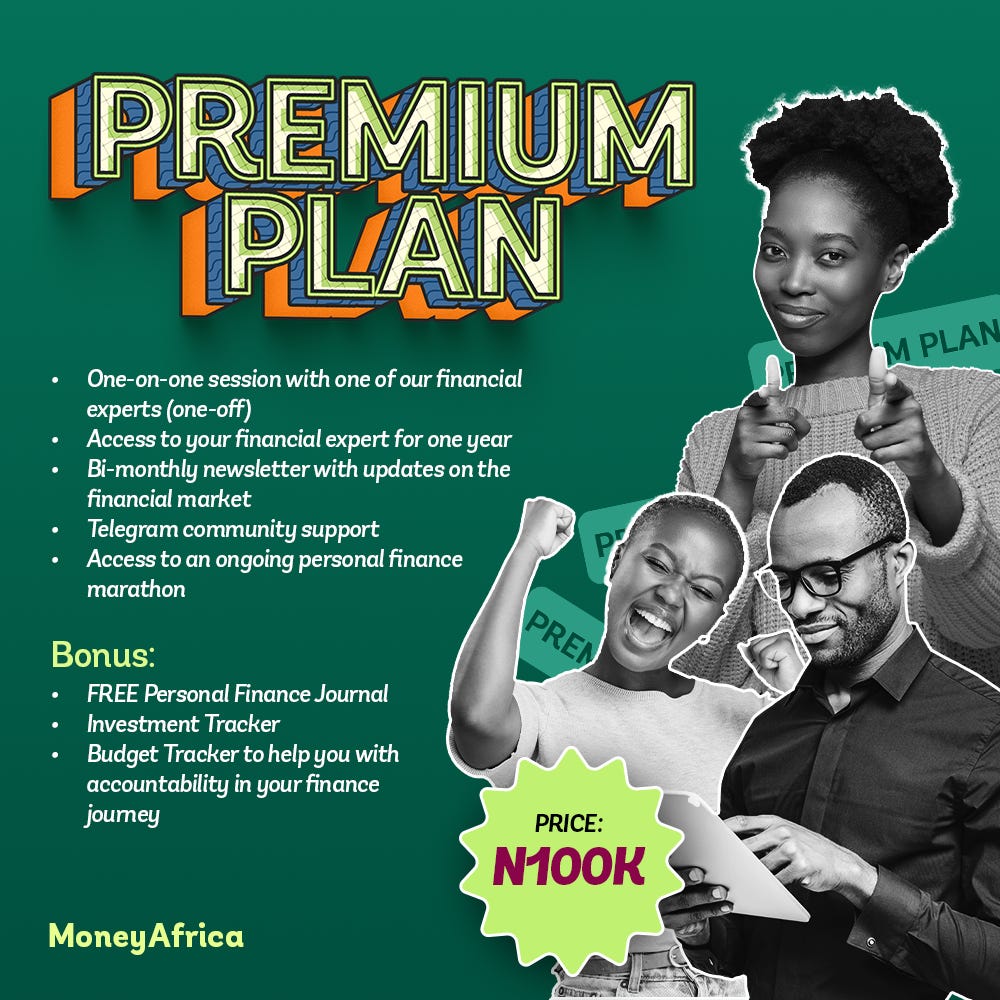

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

Join our community, if you want to smash your 2024 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

If you would like to document your financial journey in 2024, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

Get a budget sheet to track your monthly expenses. Click here

Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

- social media handles

- platforms for paid community members (for adults and students)

- webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company's staff? Please send an email to info@themoneyafrica.com