The Wealth Pyramid That You Need to Change Your Money Mindset

Last year, Otedola made a move to increase his stakes in several companies and has started this year again by investing in Dangote Cement. According to Daily Trust, Otedola said his choice of investment in Dangote Cement was determined by long-term wealth preservation, export potential and shareholder's value.

Two key takeaways from his strategy are diversification and establishing multiple income sources. This emphasises the importance of scrutinising the shareholders of the company you plan to invest in. While I acknowledge that this may not be the primary fundamentals in investment analysis, it's imperative to take this wisdom with you today. Before investing in any company, ask yourself: Who are the shareholders? No financially astute individual, having worked tirelessly for their wealth, would invest where the market lacks potential.

The distinction between the rich and wealthy lies in their financial habits. Rich people make and spend money, while wealthy people prioritise saving and investing. This implies that rich people are rich now but they could go broke if things go south. Wealthy people, on the other hand, have multiple streams of passive income to ensure a solid financial foundation to weather the storm.

This is why today I’m sharing with you 4 core principles for creating a positive financial synergy. Each level is reliant on the other, and you don’t get one without the other.

Diversify:

Many great businesses or fortunes have collapsed because they were built on just one thing—be it one product, one industry, one financial asset, or one person. Never put all your eggs in one basket. If you do and that basket falls, you will be left with nothing. When it comes to diversifying in the stock market, people often emulate experts and successful investors like Warren Buffett or the investment outlook of renowned companies. Have you taken the time to study this and assess how effective their results are?

And, of course, it’s not just about copying what others are doing, but also conducting your own research to identify what the next big thing might be. You don't need to invest all your hard-earned money in the stock market. You can consider diversifying into fixed assets, real estate, commodities, cryptocurrencies, and other avenues.

Accumulate:

Imagine if I had invested in Transcorp Hotel at the beginning of 2023, my portfolio would have increased by over 1,000% by the end of the year (2023). The question then remains: Should I still hold on to this asset or sell it? Greed would advise you to stay longer, but the wise thing to do would be to take the profit and reinvest rather than hold with the expectation that it will continue to rise. While it's possible for stocks to increase further, there are instances where having cash is crucial. Many people see their fortunes evaporate in times of crisis because they never took out gains and believed their stock would last forever. The lesson from here is to learn when to go all in and when to withdraw.

Manage:

During my sessions with clients, I always advise adopting a long-term mindset, spanning 10 to 20 years, as this is crucial when building true wealth. At some point, you will need an expert to manage your portfolio. This is because fund experts usually have access to information that you may not be aware of. They also invest more time in conducting thorough research for you and are knowledgeable about assets ranging from low-risk to high-risk. This strategically positions them to help you diversify your portfolio.

Lack of diversification and proper money management is the reason many great fortunes, including retirement accounts, disappear. If you are serious about building wealth that will outlast you, seeking assistance and having someone to guide you is essential. We have done this with over a thousand clients and you could be one of them if you send an email to sales@themoneyafrica.com to request the service of a financial expert.

Preserve:

I read an article last year about how Nigeria's wealthy men were positioning their children in some of their business units and building a legacy. How are you planning to preserve your wealth after successfully diversifying, accumulating, and managing it? Are you teaching your children the ropes, and is someone aware of your financial information in case anything happens to you? Do you have standard health insurance coverage to avoid spending money on ill health in old age?

In the wealth pyramid, preservation is essential for wealthy individuals as they approach old age. It allows them to maintain their standard of living, provide for their families and heirs, and may involve investing in low-risk assets, estate planning, and other financial strategies to safeguard their wealth for the long term.

When all is said and done, whether to retire or become wealthy, you cannot skip any of the steps discussed; otherwise, you stand the chance of losing what you have spent years building.

What are your thoughts on this?

Share with us in the comment section.

***

Would you like to know the state of your finances?

Take this test to see how you are doing financially

***

Do you know that we have our own podcast? It’s MONEYTALKS!💚

Here’s a link to listen to all the amazing episodes we have!

***

Do you have any questions? You can send an e-mail to info@themoneyafrica.com or send a DM to any of our social media channels.

***

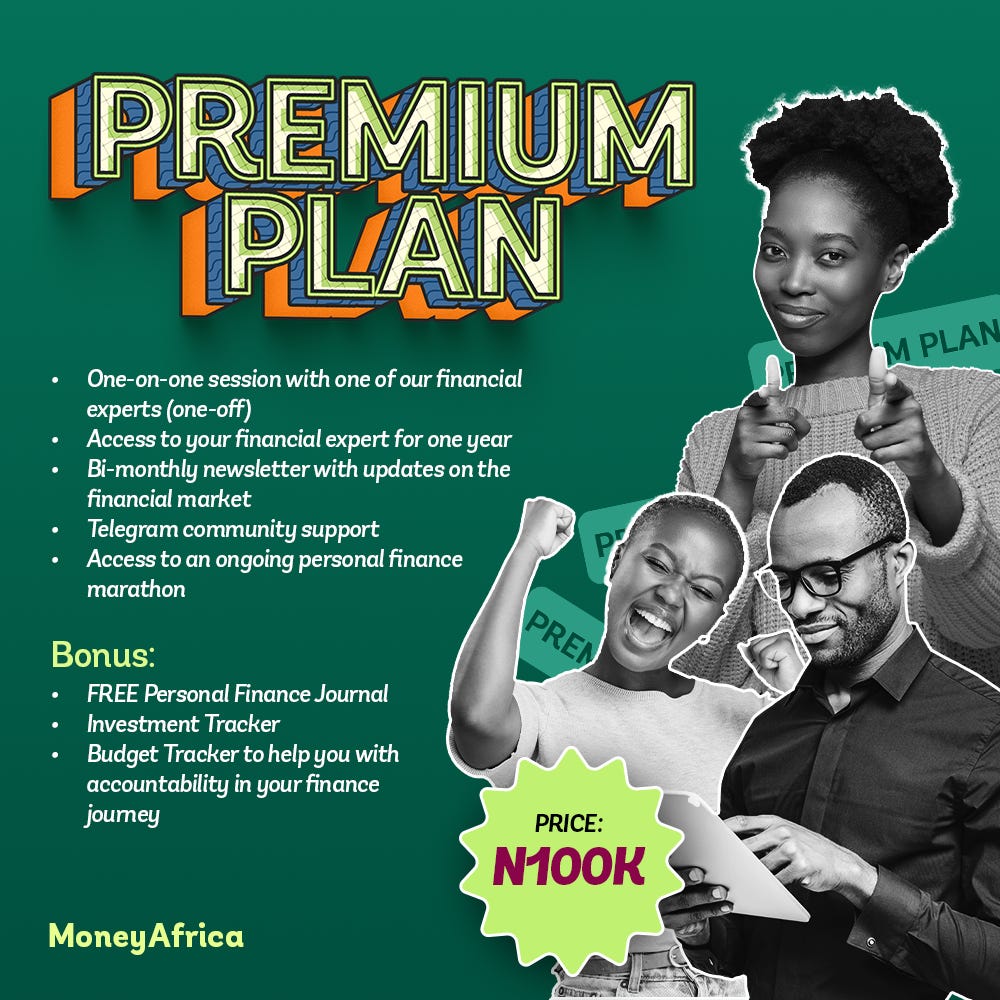

MoneyAfrica premium plan

Are you a mid to high-income earner? Do you find communities a bit too busy? You should sign up for our premium plan.

You can learn more about that here

***

We often get questions regarding how to plan your finances to align with your relocation plans, especially for students seeking to further their studies. As always, we have heard you, and we have put together an e-book to help you navigate this. Follow this link, to get your FREE copy of the e-book: The Japa Encyclopedia.

***

Get our annual subscription and learn more about investing safely and building a solid portfolio in 2023.

Don’t forget to:

Join our community, if you want to smash your 2023 financial goals. It takes at least 30 days to build great habits that will last you a lifetime. So why not start now? There is a lot you can achieve.

If you would like to document your financial journey in 2023, then our journal would be an excellent fit for you. It costs ₦7,500 (excluding delivery).

Get a budget sheet to track your monthly expenses. Click here

Get an investment tracker to be on top of all your investments. Click here

MoneyAfrica is a financial literacy platform. Our goal is to make everyone better with their finances.

We do this by engagements via our:

- social media handles

- platforms for paid community members (for adults and students)

- webinar sessions with corporate clients

Would you like to join any of the communities? Please click here

Would you like us to hold a webinar for your company's staff? Please send an email to info@themoneyafrica.com